Finally, with regards to customer care, while it takes extended discover a hold ones, it it is respond to and take care of problems. For these reasons, plus the support away from Bank away from The usa, Merrill Border is considered the most our greatest picks as the a stock exchange program. Industry-wider, the new Merrill Edge trading program is acknowledged for their reduced-payment, headache-100 percent free mind-directed platform. It is one of the best beliefs for the currency out truth be told there, especially if you are actually a merchant account holder at the Lender of The usa. The new robo-coach and you may hybrid systems labeled as Merrill Led be expensive than many other automatic change systems we’ve assessed, so that they aren’t as the rewarding.

As well as the individuals provides, the fresh inventory agents you to definitely produced all of our number never fees people commissions to trade brings. Between Questrade and you may Wealthsimple, Questrade is the better choice for really people due to its larger funding options and you will state-of-the-art exchange devices. While you are Wealthsimple now offers simplicity, Questrade provides much more have you to definitely attract a broader directory of traders, in addition to people that trade U.S. and you will Canadian holds, alternatives, and you can ETFs.

Better Online Trading Programs – Recommendations

TradeStation is the best for active buyers who will benefit from state-of-the-art charting and highest degrees of alteration. EToro phone calls by itself the new “world’s very first social using platform,” and then we delight in their provides that permit you connect with and you will benefit from almost every other traders’ education. Specific profiles enjoy the platform and you will app’s simplicity, while others is actually dissatisfied by the program and you will regular application reputation. Certain profiles as well as shown frustration that have customer support hold moments and a lack of transparency regarding rules change. At the time of very early 2025, Fidelity doesn’t provide papers exchange, a variety of simulated trading one to doesn’t risk real money, which may be a downside for most scholar buyers. In addition to, if you plan to shop for futures, you’ll have to search somewhere else.

Almost every other trick features

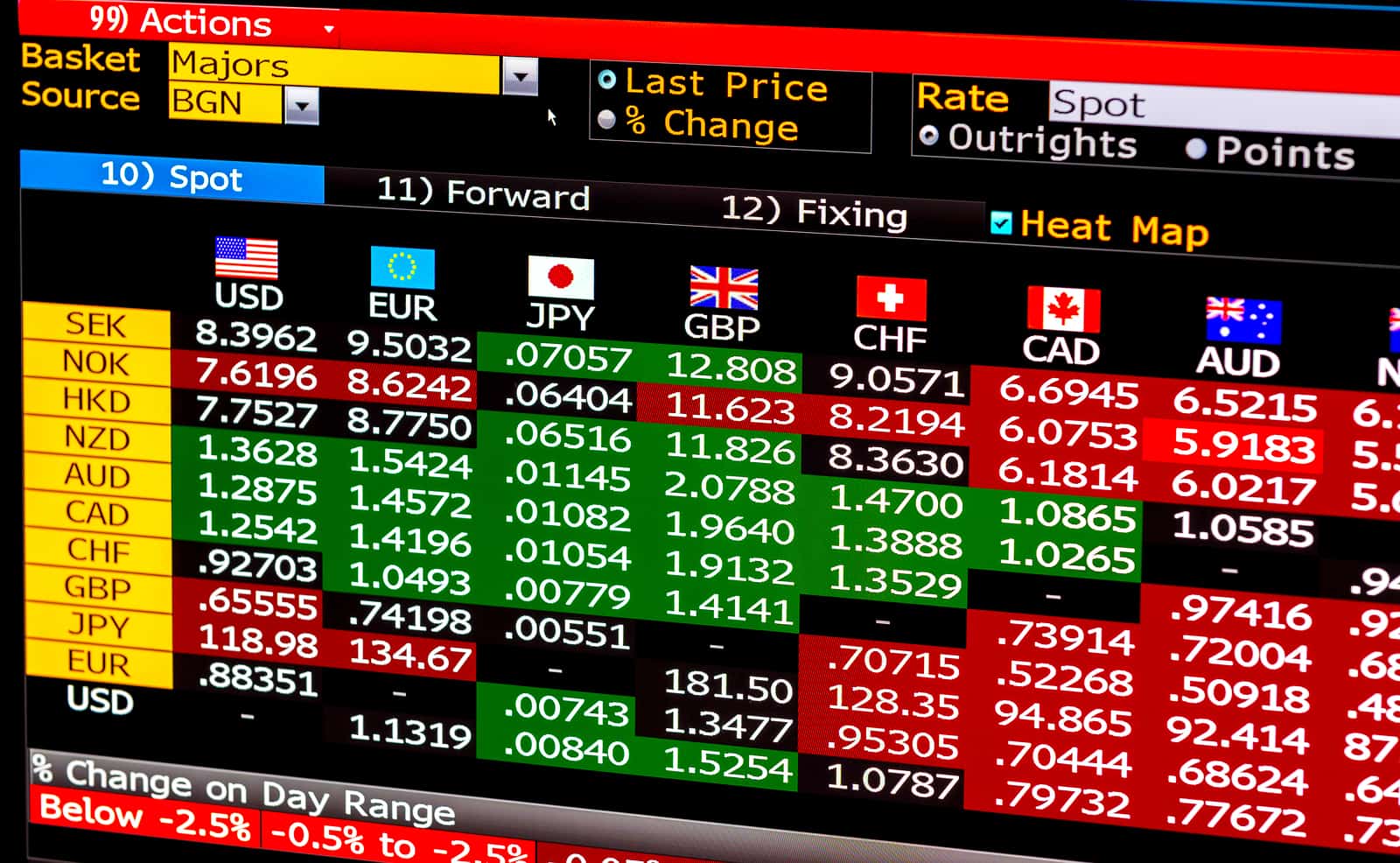

They supply precise industry investigation required for carrying out positions from the wished cost. When you’re very first accounts you will render put off estimates, significant people should think about programs or memberships that come with real-date analysis. Entertaining Brokers is certainly known as an agent to own pros and you will energetic buyers, with a powerful exchange platform, access to global places and you can a great trade delivery. It has also extended the offerings to become more attractive to own mediocre buyers.

Zero mastercard info is required, it causes it to be a fairly risk-free experience. Firstrade constantly also offers deals or rewards for earliest-day members. At the time of so it comment, the new customers you will discover up to $250 in the import percentage rebates by consolidating funding profile inside Firstrade. While we was impressed having Charles Schwab’s reduced charges, it had been a surprise to help you us that stock trading team do charge $5 for automated cellular telephone trades.

Playing with a charge card in order to put offers instant access so you can the money to help you trading that have, than the being forced to waiting days with a lender transfer, on line expenses fee, or cable import. Yet not, certain playing apex-nl.com cards may charge a cash loan commission to have including dumps. For active people, Desjardins On the internet Brokerage advises their Disnat Direct program, and this most shines with regards to price. Members having fun with Disnat Lead pay ranging from $cuatro.95-$six.95 due to their earliest 29 deals of your day, dependent on express worth and you will numbers, and only $0.75 (yes, seventy-five cents) per extra trade in the fresh few days.

Entertaining Agents immediately

Programs such as XM, XTB, and you can AvaTrade is actually managed because of the recognized bodies, making sure large amounts of shelter and you may transparency. Unless you make sure a platform’s regulating conformity, you risk losing their financing to help you fraudulent issues or lack of investor protection. For starters, platforms such as eToro clarify the newest exchange techniques thanks to CopyTrading. This particular feature allows users to help you mirror the newest investments away from educated people individually in the program.

The procedure is fairly simple – very first you complete a short survey to spell it out your goals, exposure tolerance, and you may timeline, and after that you rating a great diversified portfolio from ETFs chosen from the skillfully developed. Eventually, the newest robo-coach have a tendency to screen your own collection daily and you can automatically rebalance as required. Understand that as though you’ll complete the brand new trade on your own own, you are going to spend the money for operating expenses to the ETFs on your own collection.

The different a method to trade have a tendency to rotate to how much sense you have got, and it also’s important to choose an agent that offers the right sort of trading and you can areas based on how experienced you are. When you’re an amateur, you have to know beginning with low-risk investment thanks to a stockbroker to gain feel before progressing to riskier investment groups such leveraged change. IG and you may CMC Segments are really easy to fool around with, give loads of educational topic, change indicators, and you may meetings and they are well established. EToro is additionally the best choice because they render lower-risk money account and the capacity to reduce your leverage.

Which exchange system is perfect for beginners?

Doing this will guarantee you are equipped with the tools and you can has in order to browse unpredictable Trade Programs areas effectively. Change is high-risk and you’ll lose area, or all your funding invested. Suggestions considering is for informative and you can informative objectives simply and you may do not show any kind of financial information and you will/otherwise financing recommendation. Plus the more than, those thought to be the brand new trusted trading apps along with is covered by the fresh FSCS. Thus representative finance is actually secure up to the initial £85,100000 – should the program cease to exist.

In the Canada, AvaTrade needs a minimum put of $three hundred CAD to start a merchant account. Such as, You.S. brings provides an overnight rate of interest of 0.0308% to possess buy ranks and you will 0.0025% to have promote ranking. Which translates to so you can a 11.24% yearly margin rate charged to possess purchase ranks, which can be greater than margin cost supplied by old-fashioned brokerages. National Financial ‘s the merely biggest financial giving entirely payment-free inventory and you will ETF investments as a result of the on the web inventory broker. Federal Bank Head Broker enables you to exchange Canadian and you will U.S. holds and you can ETFs with no fee.